Drive Successful Change,

Bring

Our experienced practitioners navigate you through the complexities of digital transformation.

Our Services

Our services are meticulously curated to solve your business’ biggest challenges – from digital transformation hurdles and operational inefficiencies to organizational change – ensuring cost-efficient, customized solutions for sustainable success.

Design & Implementation

Advisory

Performance Improvement

Application Support

Opportunity Assessment

Training

Technology Enabled Services

Outsourcing

Coaching

Learn More About Our Services

Streamline your business and work smarter with Wonder Services

Unlock innovation and drive change across industries with our deeply experienced consultants and cutting-edge solutions.

Why Wonder Services?

Experience the Wonder Services Advantage

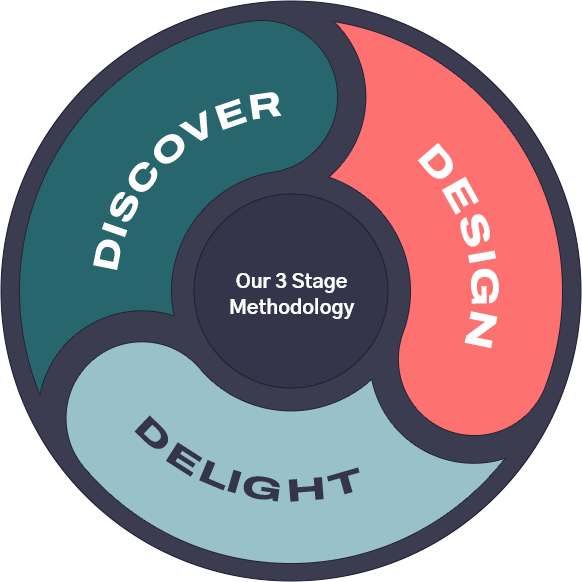

Discover. Design. Delight. is our three-phased approach tailored to meet your organization’s strategic goals. From discovering your business’ challenges to delivering delightful solutions, our hands-on support and deep expertise across sectors ensure outcomes are not only met, but exceeded.

Tech-Agnostic Approach

We are not tied to any particular vendor, allowing us to objectively evaluate and implement the best solutions that align with clients’ specific requirements.

End-to-End Support

From initial assessment to implementation and beyond, we are committed to providing comprehensive support throughout every stage of a change journey

Deep Practitioner Expertise

Our team is composed of seasoned executives and global experts across sectors, who have led global projects for some of the world’s most recognized brands.

How Wonder Services Drive Value

We Enhance Your Internal Team’s Capabilities

- Focus on leveraging and amplifying your team's strengths

- Elevating your team to peak potential for sustained success

- Deep technical expertise to innovate and solve complex issues

- Empathetic approach with first-hand experience in your challenges

We Provide Sustainable Solutions

- Unique solutions customized for your organization's needs and industry challenges

- Forward-thinking strategies designed for both immediate impact and long-term success

- Adaptable and sustainable solutions that are not just for today, but built for the future

We Maximize Your Technology Investment (ROI)

- Comprehensive change management with user-adoption at the center of what we do to ensure people are brought along throughout

- First-hand experience with a track record of successful transformations that resonate with your team and organization's reality

- Cost-efficient solutions that reshape projects into profit-driving engines

Want to optimize your business? Do not hesitate!

About Us

Wonder Services:

Powered by our people

Our team harnesses the power of change to drive transformation.

We don’t just consult; we partner to lead companies towards wonderful success. Experience the unique Wonder advantage on every project.

Amanda Prochaska

Raven Fowler

Kaitlyn Smith

Madison Imoto

Lauren Skipper

Testimonials

We sat at the conference and realized that Wonder Services taught us all the important aspects of digital transformation. We cannot thank you enough.

This training is incredible. Thank you for caring for our end users so much and for putting in the effort into everything you do

We had never looked at this as a company before working with Wonder Services. We are now aligned in how we are measuring success through our simplified workflow.

Contact Us

Get in touch

If your needs are specific, our offering is vast. Fill in the form, we'll email you for a no-obligation chat and we can figure it out together!

"*" indicates required fields